Getting Started

Network Tokens

Network Tokenization is a standard introduced by major card networks to tokenize card details. Network Tokens replace sensitive card details (like the 16-digit card number, expiration date, and security code) with a unique identifier generated by a card network (e.g. Visa or Mastercard). This token is used to process payments without exposing actual card details, thus adding a layer of security. For merchants, this can also result in higher authorization rates and lower authorization fees.

They’re designed to look exactly like a real card number, complete with a similar length and an expiry date, making them compatible with existing payment infrastructure. Since Network Tokens are simple identifiers and not real card numbers, merchants can store them without expanding their compliance obligations, such as those required by PCI standards.

Unlike traditional card details, Network Tokens are directly linked to specific Merchants. When a Merchant creates a Network Token with the card network, it can only be used for transactions by that Merchant alone. This restriction introduces an additional security measure: should a token be compromised, it can be deactivated without requiring a new card to be issued or impacting Tokens linked to that card across different merchants. This also leads to a significant reduction in fraud risk, as stolen Network Tokens can not be used with any other merchant.

How Network Tokens Work

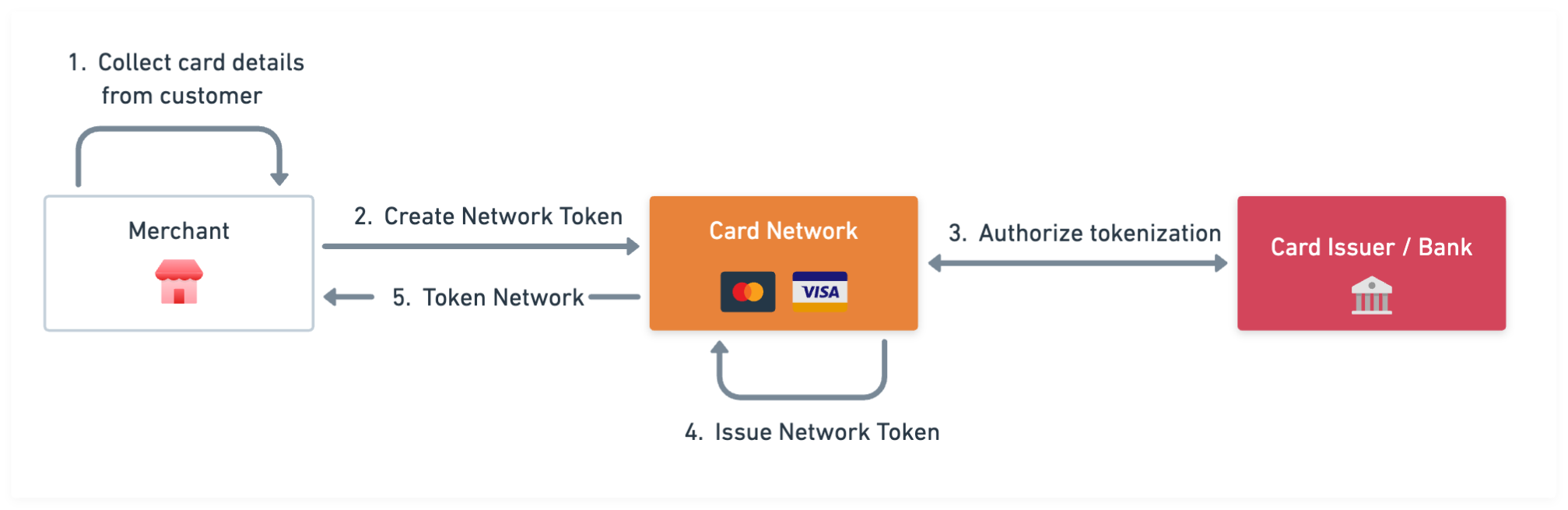

Tokenization Process: The tokenization journey commences as the merchant gathers the customer's card information on the checkout page. Once the card details are captured, the merchant creates a Network Token by submitting the card details to the relevant card network, such as Visa or Mastercard. The card network first authorizes the tokenization request with the issuer of the card. This authorization step ensures that the token is linked accurately to the card with the issuer's approval. Once tokenization is authorized, the card network generates a unique token that is associated with the merchant. The generated Network Token is then returned to the Merchant and stored for future use.

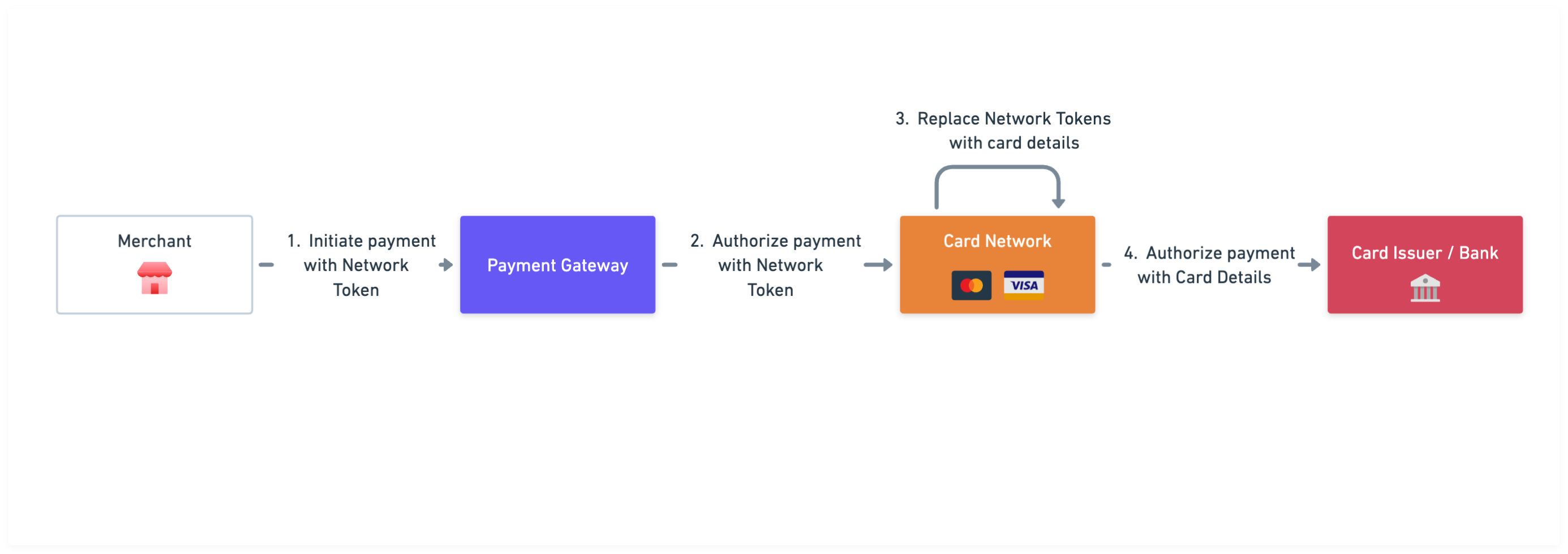

Processing payments using Network Tokens: During a transaction, a Network Token is sent to the payment gateway or card network instead of the original card details. Once a transaction reaches the network, the token is replaced by the original card details and then processed as usual by the card issuer. As a result, the card details are only handled by the card issuer and the card network, minimizing the number of points where this data is exposed.

Benefits of using Network Tokens

Using Network Tokens to process payments offers a number of benefits compared to using raw card details:

Improved authorization rate — Because tokens are issued and recognized by the card networks and are specific to the merchant or transaction type, they often carry additional data that can assist in the authorization process. This data helps issuers more accurately verify the legitimacy of a transaction. As a result, legitimate transactions are less likely to be declined due to suspicion of fraud, improving the overall experience for both customers and merchants. Merchants typically experience a 3% increase in authorization rates when utilizing Network Tokens instead of traditional card numbers.

Automated card updates - Unlike traditional card numbers (which remain static until manually updated by the cardholder in the event of expiry or reissuance), Network Tokens are dynamically updated. Card networks ensure that tokens reflect the most up-to-date card information, including automatic updates for expiration dates or replacement card numbers. This automatic renewal feature removes the common friction point of transactions being declined due to outdated card details.

Reduced fraud — Since tokens replace sensitive card information with a unique digital identifier associated with a single merchant, the actual card details are never exposed during the transaction process — minimizing exposure to potential fraud. If a token is compromised, it can be suspended or invalidated by the issuing network without affecting the underlying card or the cardholder's ability to make purchases through other channels.

Lower interchange fees - One of the lesser-known yet financially impactful benefits of adopting network tokens in payment processing is the potential reduction in interchange fees. Interchange fees are the costs that merchants pay to card networks for the processing of credit and debit card transactions. Some card networks offer specific incentives and reduced interchange rates for transactions that utilize network tokens, as part of their push towards adopting more secure payment technologies.

Reduced PCI compliance scope — By using tokens instead of storing, processing, or transmitting card numbers directly, merchants handle less sensitive data. This reduction in handling sensitive data can decrease the complexity and costs associated with maintaining PCI DSS compliance, as the stringent security requirements become applicable to a smaller portion of the merchant's payment ecosystem.

Simplified payment gateway integrations — Since the tokenization and de-tokenization processes are handled by the card networks (e.g. Visa or Mastercard), merchants can process payments across different payment gateways without depending on each gateway's proprietary tokenization system. Merchants therefore need only a single tokenization integration to work with various payment processors and gateways, significantly simplifying the payment infrastructure.

How to start using Network Tokens

Evervault provides a set of easy-to-use APIs designed to let you create and use Network Tokens in minutes without having to integrate directly with the card networks. To assist you in getting started, we've prepared a series of quick start guides. These guides are designed to walk you through each step of the Network Tokenization process, ensuring a smooth and efficient setup.

Use a Network Token when processing a charge

Learn how to process charges with Network Tokens

Get StartedHandle Network Token Updates

Learn how to handle token updates from the Card Networks so that your payment credentials are always up to date

Get Started